THIS savvy pensioner was a step ahead of

scammers who tried to access his details through a fake tax email.

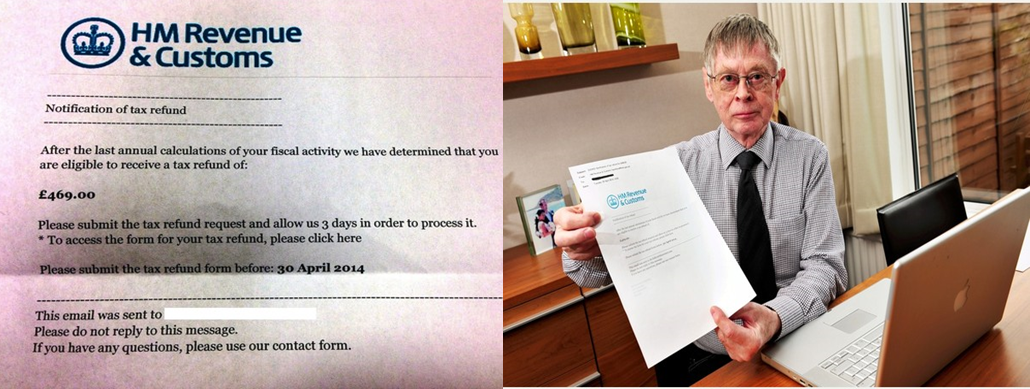

Former railway worker Ken Fuller, 80, received

an email claiming to be from Her Majesty's Revenue and Customs, inviting him to

claim a 'tax refund' of £469,

following 'annual calculations of his fiscal activity'.

To claim his rebate, all he had to do was fill

in the attached refund form and submit it by the following day.

Like most scams, it sounded too good to be true,

and it was. Mr Fuller, of Grimsby, suspected all was not as it seemed, and

called HMRC which confirmed it was a fake.

Ken, of Timberley Drive, said he wanted to warn

others to be vigilant against such scam

attempts, so people don't fall victim to their cons.

He said: "It came out of the blue. I was

just checking my e-mails on my computer when I saw it had come through.

"It looked bona fide. It had the exact logo

that you get on tax letters. But something about it wasn't right, I was

immediately suspicious.

"I contacted HMRC the next morning and they

asked me to send it to their 'phishing' email address, so they could take a

look at it."

The tax office sent a reply confirming it would

never contact people via email about being eligible for a repayment or to ask

for personal information or payment.

According to consumer site Money Saving Expert,

clicking on the attached link risks uploading a virus to the person's computer.

Often, these are designed to steal your banking

and other sensitive login details.

Figures show that during 2013, customers

reported more than 91,000 phishing e-mails to HMRC.

Ken said: "It's sad to know someone is out

there trying to deceive you. There are a lot of scams out there, you are always

hearing about them, but this was an unusual one.

"I'm not particularly computer savvy but I

suspected something wasn't right about it.

"It did look very official though. I know

because I normally fill out my tax reconciliation at the end of each financial

year.

"It definitely makes you more wary about

what you are receiving. It came out of the blue for me."

A spokesman for HMRC said: "We only ever

contact customers who are due a tax refund in writing by post. We don't use

telephone calls, e-mails or external companies.

"Anyone who receives an email claiming to

be from HMRC should send it to phishing@hmrc.gsi.gov.uk before deleting it

permanently."

Ken reiterated the message that other people

should be extra careful when responding to e-mails claiming to be from

reputable origins..

"It's really important that people are

aware," he said.

"If I can help one person from getting

scammed and getting into hassle, then I'll be happy."

Gareth Lloyd, head of digital security at HMRC,

said the organisation was working to track and down close the rogue websites

responsible for such scams.

"HMRC never contacts customers who are due

a tax refund via email – we always send a letter through the post," he said.

"We can, and do, close these websites down,

and do all we can to ensure taxpayers stay safe online by working with law

enforcement agencies around the world to target the criminals behind these

scams."